Are Service Awards Taxable In Canada

Tufts does not withhold taxes to US Citizens and Resident Aliens. The CRA also sets a limit to how many gifts and awards that are not considered taxable benefits that one employee can receive in a year.

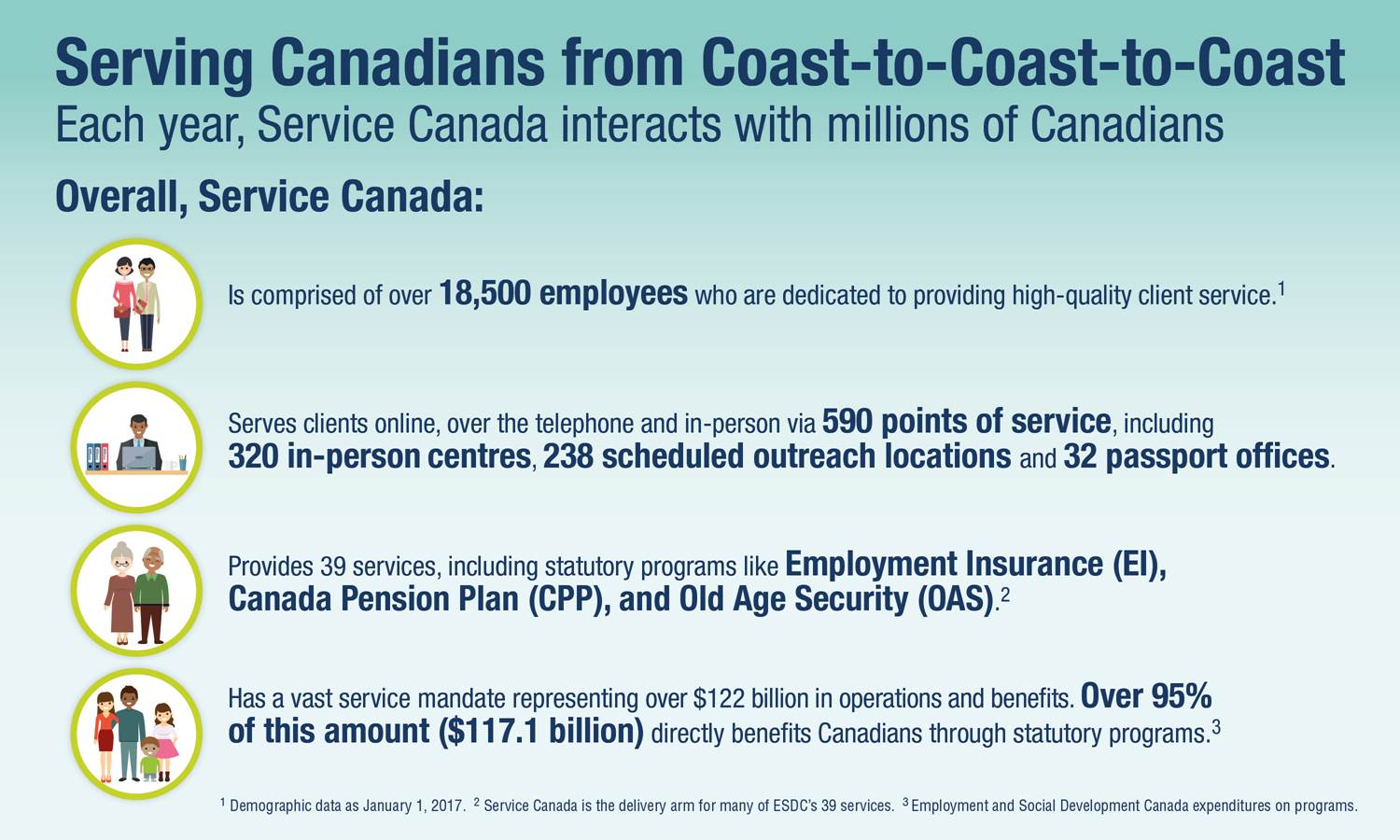

Serving Canadians From Coast To Coast To Coast Infographic Canada Ca

In 2020 the Tax Court of Canada published its decision for Saunders v The Queen 2020 TCC 114.

Are service awards taxable in canada. You and your employee would benefit more from an item or gift card reward as these can be exempt from tax as long as they are 50 or less per year of service. Compensation for legal fees is deductible for employees. The issue in this case is whether monetary awards received by employees following a successful grievance against their employer is taxable as employment income.

Yes since Ahmed has worked for the company for less than 5 years this long service award does not meet the parameters of the policy and is taxable. Gifts and Awards Employers 16 may give their employees tax-free gifts and awards to mark special occasions or in recognition of certain exceptional accomplishments provided their total combined value does not exceed 500. Theyre all the same thingawards that recognize employees when they hit a specific work anniversary 5 10 15 20 years of service.

The Canada Revenue Agency CRA determines what can and cant be taxable and with the constant changes it can be challenging to decide what can be submitted as a deduction. Length of service awards are federal taxable wages if given before 5 years service but non-taxable after 5 years service and not more frequently than every 5 years. Long Service Retirement Non-Cash Awards Non-cash awards are taxable as they are granted in respect of employment.

Did you know your Service Award gifts may not be taxable. Honorariums are considered taxable income by the IRS. You may have some valuable company perks such as a cell phone tuition reimbursement or service awards.

Whether a prize is taxable or not depends on what it is and how you got it. Bill retains tax exclusion for employee achievement awards Unlike other awardsrewards such as points gift cards and vouchers which your employees must claim as taxable income service and safety achievement awards when a part of a conforming plan are not considered a taxable benefit. Information on the long-service or anniversary award.

Examples of taxable goods and services can be found in the CRA Guide RC4022 under the heading Taxable Goods and Services. Most goods and services purchased in Canada or brought into Canada are taxable. Yes service awards can be given as cash however cash gifts are always taxable.

Any amount beyond the threshold of 500 will have to be included in the employees income. Where the payment is made directly from the employer to the employees legal adviser this amount is non-taxable. Safety awards are excluded from federal taxable wages if also given to management administrative professional clerical and part-time employees but not to more than 10 of eligible employees during the.

In general if prize money is regarded as part of the normal way in which people following a profession earn money whether they are a golf player or an artist then the prize money is earned income and is taxable. How Service Awards Have Changed. Is Long Service Award taxable.

Are Awards Taxable A Tax Court of Canada Example. According to Revenue Canada a retiring allowance is an amount intended to compensate an employee for their long service or the loss of their employment. Counselling services have been defined to include job placement re-employment and retirement counselling services.

What are the conditions for tax exempt awards. The employee must have had a period of service of at. Fortunately non-cash award items of small or trivial value do not need to be counted the years total at all.

Such awards are considered taxable benefits under Canada Revenue Agency rules and are often listed under both their gross value reported to the taxman and the net value in the hands of the. General damages are non-taxable. If you win the lottery your prize is tax-free.

And you dont have to pay any kinds of taxes or fees to the Canada Revenue Agency CRA before you claim your prize. Years of service awards are also called milestone awards service awards service milestones length of service awards employee anniversaries and service anniversaries. A retiring allowance is distinct from notice damages which are employment income.

Award in recognition of running the company charity drive. Long service awards made to employees as a testimonial to mark long service are not taxable provided the following conditions are satisfied. However if you earn an award which you dont enter it cannot be competed for and is awarded as a mark of honour or distinction then the award is not taxable.

But these may not provide any tax benefits. This is a scam and if someone tells you that you need to pay to receive a prize youve won through a lottery or sweepstakes you. Gifts and awards outside our policy Cash or near-cash gifts hospitality rewards manufacturer-provided gifts and some other gifts and awards are always taxable.

Sales Taxes - GSTHST - Exempt and taxable including zero-rated goods and services GSTHST Taxable Goods and Services.

Top 10 Non Taxable Benefits For Employers In Canada Enkel

Automated Fare Collection System Iba Group Public Transport System Transportation

Why Choose Mexico For Dentistry Dental Tourism Mexico Dental Vacation Cancun Dental Tourism Dental Dentist

Brampton Service Canada Centre

The Best Ways To Maximize Air Canada S Aeroplan Program The Points Guy Book Awards Air Canada Flights The Points Guy

Posting Komentar untuk "Are Service Awards Taxable In Canada"